Atlas Shrugged, part I, chapter X

Last time, Lee Hunsacker had mentioned to Dagny that he was the only one who ever beat Rand’s superhero banker Midas Mulligan. Now he’s going to tell us how:

“Midas Mulligan was a vicious bastard with a dollar sign stamped on his heart,” said Lee Hunsacker… “My whole future depended upon a miserable half-million dollars, which was just small change to him, but when I applied for a loan, he turned me down flat – for no better reason than that I had no collateral to offer.

…By what right did he pass judgment on my ability? Why did my plans for my own future have to depend upon the arbitrary opinion of a selfish monopolist? I wasn’t going to stand for that. I wasn’t going to take it lying down. I brought suit against him.”

“You did what?”

“Oh yes,” he said proudly, “I brought suit. I’m sure it would seem strange in some of your hidebound Eastern states, but the state of Illinois had a very humane, very progressive law under which I could sue him. I must say it was the first case of its kind, but I had a very smart, liberal lawyer who saw a way for us to do it. It was an economic emergency law which said that people were forbidden to discriminate for any reason whatever against any person in any matter involving his livelihood… and, therefore, we were entitled to demand a loan from him under the law.” [p.296]

We’re told that Hunsacker’s lawsuit initially came before Judge Narragansett, another of Rand’s ubermenschen, who sat silently through the trial and then ordered the jury to rule for Mulligan. (Er, since when can judges do that?) Hunsacker then won on appeal, but was never able to collect because Mulligan shut down his bank and vanished.

I wrote last week about people who believe that they’re living in this book, who think that things work the same way in the real world as they do in the world of Atlas Shrugged. There’s no better example of this than the libertarian response to the most colossal market failure of our era, the subprime lending crisis.

The root of this crisis was a classic speculative bubble where banks loaned huge amounts of money to unqualified borrowers, assuming that real estate prices would keep going up so that the houses could be resold or refinanced. What made this bubble even worse was the widespread creation of collateralized debt obligations, or CDOs for short, in which pieces of many different mortgages were sliced and diced and packaged into new securities that were resold to investors, who believed that in this way they could magically reap higher returns without greater risk. But as with every other bubble, eventually things came crashing down, as borrowers defaulted en masse, plunging the country into a recession it still hasn’t recovered from.

To most of us, the subprime mortgage crisis typifies the destructive herd behavior that’s inevitable in a market without government regulation and oversight. But that conclusion is unacceptable to Randians and other libertarians, who can’t accept that the free market could fail as spectacularly as this. They’re convinced that the government must be to blame somehow, and their usual scapegoat is a 1977 law called the Community Reinvestment Act.

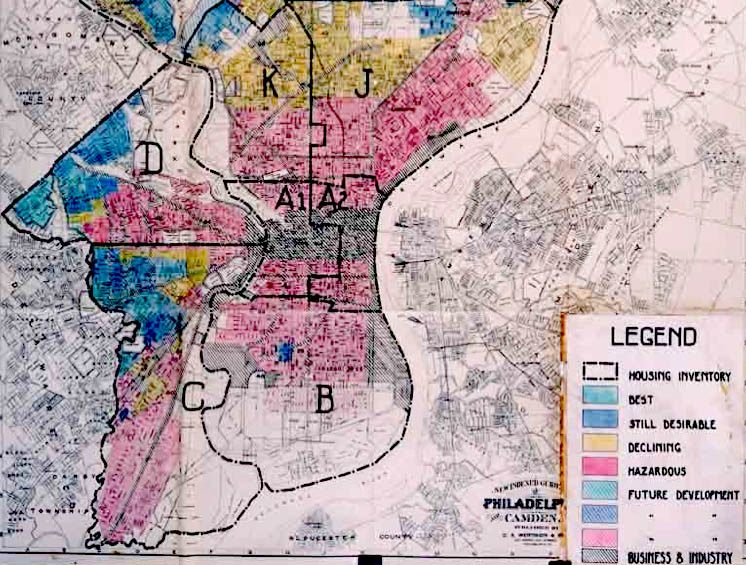

The CRA was passed to combat redlining, the discriminatory practice of offering less favorable terms to equally qualified minority borrowers, or outright denying credit to people simply for living in minority neighborhoods. Nothing in the CRA requires banks to lend money to people who weren’t otherwise qualified – but that hasn’t stopped libertarian commenters and right-wing pundits from repeatedly asserting that it’s a real-life version of Hunsacker’s law:

The Community Reinvestment Act (CRA) set all this in motion. It forced banks to make loans to low-income individuals with poor credit ratings. Should we be surprised when quite a few of these people default on their loans?

This was a result of excessive government regulatory oversight rather than too little. Banks wouldn’t have made these risky loans if the Fed and other institutions weren’t forcing them to.

The libertarian need to fit everything that happens into a narrative where government is the only source of evil in the world leads them to overlook some obvious holes in this. To name just one, if the banks were being forced by the government to make risky loans that they didn’t expect to be repaid, they’d have made their process slow and meticulous. They’d have required stringent terms and extensive documentation. And the free market (which is never wrong according to Rand) would have rated these loans as the toxic junk debt they were, and no one would have been willing to buy them.

In fact, what happened was the opposite. In the last days of the subprime boom, mortgage lending became a wild, speculative frenzy. Former loan officers have testified that they were under tremendous pressure to approve as many loans as possible, as quickly as possible. No documentation was required; gardeners and mariachi singers who claimed to have six-figure incomes were approved without question. And as fast as the banks could mint these loans, the rating agencies were happy to stamp triple-A ratings on them, and other investors snapped them up.

We have ample historical evidence showing that this kind of reckless, greed-driven behavior, leading to the inflation of bubbles and ensuing economic collapse, is what inevitably happens in a market with insufficient regulation and oversight. From tulip bulbs to railroads, from subprime loans to the 1929 market crash that precipitated the Great Depression, we’ve seen it happen over and over again. A government watchdog is the only way to keep these kinds of bubbles in check, or at least mitigate the damage they do – but because Rand and her followers refuse to learn from history, they oppose all government intervention, and therefore make it more likely that economic bubbles will continue to form and catastrophically burst.

Image: A 1936 map of Philadelphia showing minority neighborhoods targeted for redlining. Credit: Wikimedia Commons

Other posts in this series: